Introduction

With $4.1 billion lost to DeFi hacks in 2024, the importance of secure storage solutions has never been more critical. The rise of cryptocurrency has provided users with unprecedented access to the digital economy, yet it has also introduced new challenges in securing these assets. Cold storage for cryptocurrency serves as a vital fortress in this world of digital finance. This comprehensive guide aims to delve into the best practices and technological advancements in cold storage solutions you should adopt in 2025.

What is Cold Storage for Cryptocurrency?

Cold storage refers to the practice of keeping cryptocurrency offline. This method significantly reduces the risk of hacks compared to hot wallets, which are connected to the internet. It’s akin to a bank vault for your digital assets, providing a higher level of security. In 2025, as more institutions and individuals adopt cryptocurrencies, cold storage will become increasingly essential.

Why Cold Storage? The Risks of Digital Assets

- DeFi Vulnerabilities: Decentralized finance platforms are frequently targeted.

- Hack Statistics: In 2024 alone, DeFi projects faced losses exceeding $4 billion due to hacks and exploits (Source: Chainalysis).

- Market Growth: Vietnam’s crypto user base is projected to grow by 45% in 2025, increasing the demand for secure storage solutions.

By employing cold storage, users can effectively mitigate these risks and safeguard their investments.

Types of Cold Storage Solutions

There are various types of cold storage, each with its unique features and benefits:

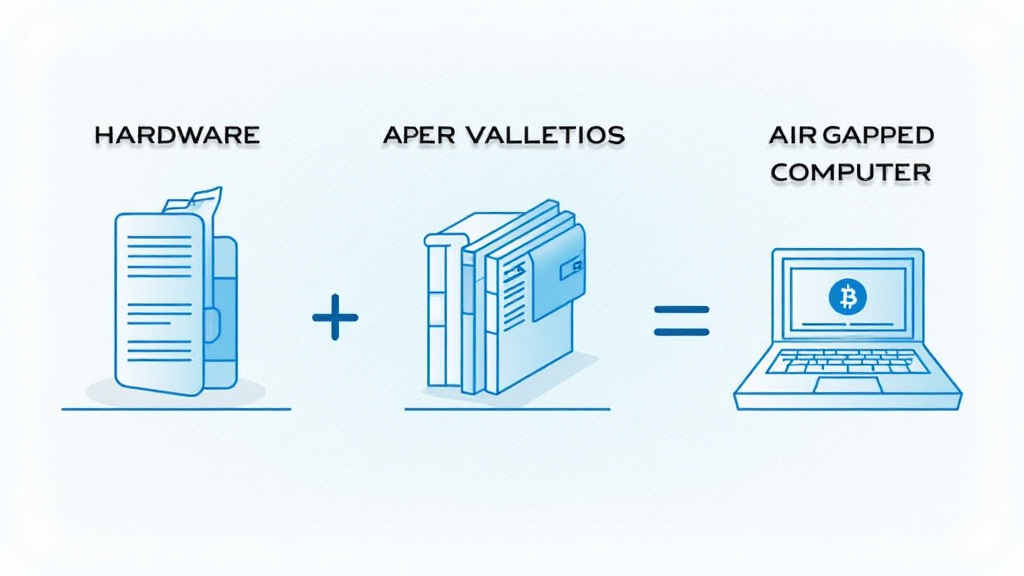

Hardware Wallets

Devices like the Ledger Nano X are designed to store private keys offline. They are widely recommended because of their high security and ease of use. Research indicates that using hardware wallets can reduce hacking risks by up to 70%.

Paper Wallets

A more traditional method, paper wallets involve printing your keys and QR codes on paper. While they are highly secure against online threats, they are vulnerable to physical destruction or loss.

Air-Gapped Computers

For more advanced users, using an air-gapped computer—one that is never connected to the internet—can provide an extra layer of security when managing their assets.

Best Practices for Implementing Cold Storage

Here’s how to make the most of cold storage for your cryptocurrencies:

1. Choose the Right Solution

Depending on your investment size and usage frequency, choose a wallet that meets your needs. For instance, many investors prefer hardware wallets for long-term holdings.

2. Regular Backups

Ensure that you back up your wallets securely. This could mean keeping physical copies in safe locations to protect against loss or theft.

3. Security Protocols

Employ best security practices, such as enabling two-factor authentication and frequently updating your security measures.

Understanding Cold Storage vs. Hot Wallets

It’s essential to understand the differences between cold and hot wallets for effective asset management. Hot wallets are convenient for daily transactions but expose users to more risks due to constant connectivity to the internet. In contrast, cold storage, while less convenient, offers unparalleled security for long-term holdings. The trade-off between security and convenience must be carefully evaluated based on individual needs.

Recent Innovations in Cold Storage Technologies

The landscape of cryptocurrency storage continues to evolve:

Biometric Hardware Wallets

Emerging biometric technologies offer enhanced security features. Biometric identification, such as fingerprint or facial recognition, can provide an additional layer to secure access to cold wallets.

Multi-Signature Wallets

Multi-signature wallet technology enhances security by requiring multiple private keys for transaction approvals. This is particularly useful for businesses or joint accounts.

Vietnam’s Growing Crypto Landscape

As Vietnam’s cryptocurrency user base expands, the demand for secure storage grows. In 2025, reports project a 45% increase in active crypto users in the country. Local exchanges are now beginning to implement better cold storage solutions in response to this demand, indicating a shift towards increased awareness of security practices among Vietnamese investors.

Conclusion

In 2025, investing in cold storage for cryptocurrency will be crucial in safeguarding digital assets against theft and loss. As the industry grows and more individuals immerse themselves in the world of crypto, the need for secure storage protections, such as hardware wallets and air-gapped computers, will only increase. Remember the “tiêu chuẩn an ninh blockchain” as a guideline for evaluating your security protocols. By adopting best practices and technologies in cold storage, you can ensure the safety of your investments in this ever-evolving digital economy.

For the latest developments in secure cryptocurrency storage practices, visit hibt.com. Remember that investing in cryptocurrencies carries risks, and you should consult local regulators before making any decisions regarding your assets.

About the Author

Dr. Alex Chang is a renowned blockchain security expert with over 15 published papers in the field and has spearheaded audits for projects like DeFi Protocol and CryptoSafe.