Introduction

In 2024, the global remittance market reached an astonishing $700 billion, with emerging markets such as Vietnam witnessing significant growth. More than ever, individuals and businesses are looking for faster, cheaper alternatives to traditional remittance methods. Here’s where Vietnam crypto remittance comes into play. With the advancements in blockchain technology, remittances through cryptocurrencies are not only reducing costs but also increasing the speed of transactions, offering greater convenience and security for users.

Understanding Vietnam’s Remittance Landscape

According to the World Bank, Vietnam is one of the top recipients of remittances globally, with around $18 billion received in 2024 alone. The increasing number of Vietnamese workers abroad has contributed to this boom. However, traditional remittance methods often come with high fees and lengthy processing times, prompting individuals to seek innovative solutions.

- The average fee for sending money to Vietnam can be as high as 7%, depending on the provider.

- Blockchain technology promises to cut these fees significantly, potentially as low as 1%.

- Vietnam has a burgeoning crypto community, with over 5 million active users as of 2024, making it ripe for crypto remittance solutions.

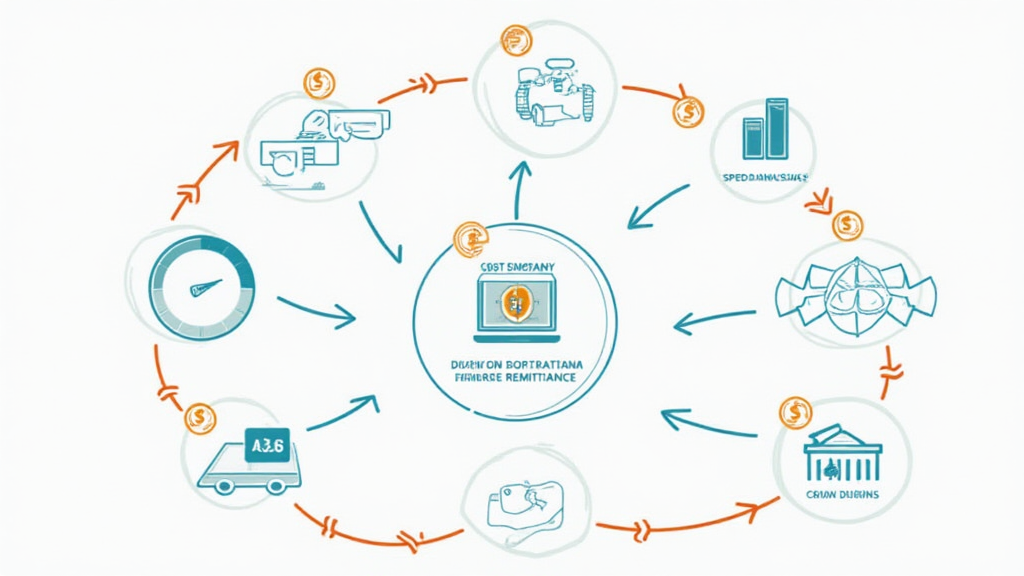

The Mechanics of Crypto Remittance

Cryptocurrencies like Bitcoin, Ethereum, and the Vietnamese Dong-backed stablecoin are transforming how remittances are sent and received. Let’s break it down:

Speed and Cost-Efficiency

Using a cryptocurrency to send remittances involves several steps:

- Sender initiates transaction: The sender converts their local currency into cryptocurrency via a digital wallet.

- Transaction validation: The transaction is confirmed on the blockchain, typically within minutes.

- Recipient receives cryptocurrency: The recipient can exchange the cryptocurrency back into local currency or use it for purchases.

This process eliminates the need for intermediaries, drastically reducing costs associated with remittances.

Security: An Essential Element

Security is paramount when handling financial transactions. Here’s how blockchain ensures high standards:

- Decentralization: No single entity controls the network, reducing the risk of fraud.

- Encryption: Transactions are encrypted, making them tamper-proof.

- Blockchain transparency: Every transaction is recorded on a public ledger, providing a high level of accountability.

This level of security is far superior to traditional systems, which often suffer from data breaches and fraudulent activities.

The Power of Stablecoins in Vietnam Crypto Remittance

Stablecoins are particularly noteworthy in the context of Vietnam crypto remittance. These cryptocurrencies are pegged to stable assets, such as the USD or Vietnamese Dong, minimizing volatility. The benefits include:

- Stable value: Protects users from the fluctuations commonly seen in the crypto market.

- Easier conversions: Users can convert to and from fiat currency without worrying about losses during market shifts.

In Vietnam, stablecoins can facilitate smoother transitions between crypto and fiat currencies, especially important for remittance purposes.

The Growing Adoption of Crypto Remittance in Vietnam

The growth of crypto remittance in Vietnam is reflective of broader trends in Southeast Asia. With increasing internet penetration and smartphone usage—over 70% as of 2024—the infrastructure is becoming conducive to embracing cryptocurrencies. Notable trends include:

- Educational initiatives: Workshops and online resources are emerging to educate users on cryptocurrencies and blockchain.

- Local exchanges: The establishment of Vietnamese crypto exchanges has provided easier access for users to buy, sell, and trade cryptocurrencies.

- Government interest: Although regulations are still being developed, the Vietnamese government’s interest in blockchain technology signifies potential future support.

Challenges and Considerations

While the opportunities in Vietnam’s crypto remittance space are significant, challenges remain:

- Regulatory Framework: The lack of clear regulations can create apprehension among users and providers.

- Volatility of Cryptocurrencies: Despite stablecoins, the traditional cryptocurrencies still face price fluctuations which could impact remittance values.

Understanding these challenges is crucial for both consumers and businesses as they navigate this new financial landscape.

Conclusion

In conclusion, Vietnam crypto remittance is poised to revolutionize how money is transferred globally. With the potential for lower costs, faster transactions, and enhanced security, cryptocurrencies offer a viable alternative to traditional remittance methods. As technology advances and understanding of blockchain grows, Vietnam could become a leading hub for crypto remittances in the region. For more insights into the evolving landscape of digital finance, consider exploring resources at hibt.com and checking our Vietnam crypto tax guide.