Understanding Crypto Market Cycles: Insights and Predictions

With the cryptocurrency market fluctuating wildly, many investors are left scratching their heads, wondering what leads to these huge swings in value. Did you know that over $4 billion was lost in DeFi hacks in 2024? That’s right! The volatility in the crypto market is real, and understanding its cycles is crucial for anyone looking to navigate this space effectively. This article will not only delve into the mechanics of crypto market cycles but also shed light on how you can harness this knowledge for better investment decisions.

The Fundamentals of Crypto Market Cycles

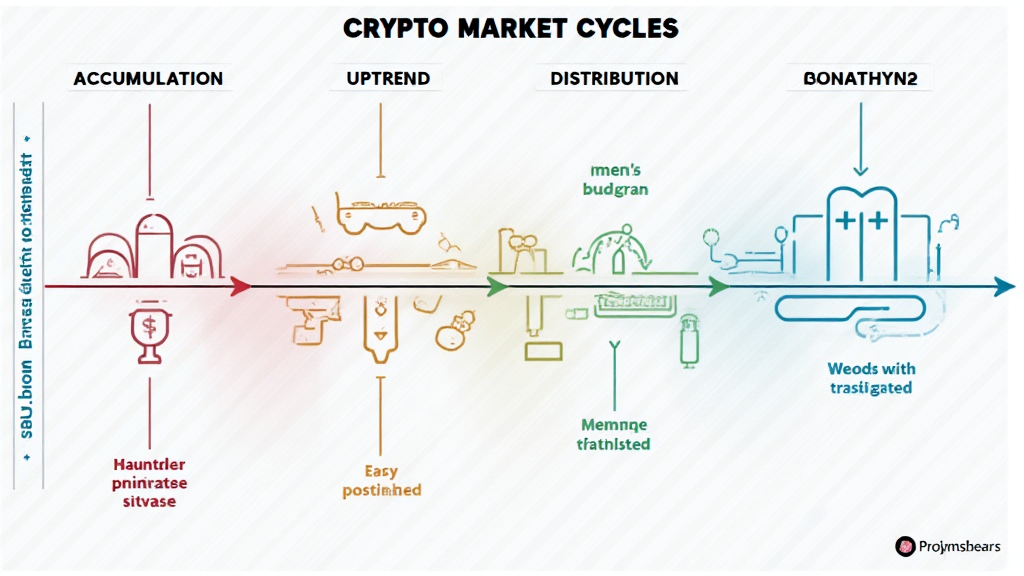

A crypto market cycle typically consists of a phase of accumulation, followed by a period of rapid growth or a bull market, eventually leading to a market correction or a bear market. Here’s a simplified breakdown:

- Accumulation Phase: Investors slowly begin to buy assets as prices stabilize after a downturn.

- Uptrend Phase: Prices rise as more investors enter the market, often driven by news, technological advancements, or increased adoption.

- Distribution Phase: During a peak, early investors may begin to sell off their assets, leading to a stabilization of prices.

- Downtrend Phase: Prices fall as market sentiment shifts to fear, often exacerbated by negative news or regulatory concerns.

Understanding these phases can provide insight into potential investment strategies. For instance, recognizing the accumulation phase may signal an opportune moment to buy.

Market Psychology and Its Impact on Crypto Cycles

The psychology of market participants plays a crucial role in crypto cycles. Factors such as fear, greed, and herd mentality create waves that can drive the market up or down. Studies show that during a bull market, greed can lead to irrational buying, while in bear markets, fear often compels investors to sell hastily.

Consider this: according to a 2025 industry report by Chainalysis, the sentiment analysis following major price drops revealed that 78% of retail investors were worried about future losses, leading to accelerated sell-offs. On the other hand, during significant price increases, the same analysis indicated that over 65% of speculators felt “FOMO” or the fear of missing out, which further fueled the price surge.

Cyclical Patterns and Historical Data

To appreciate the crypto market cycles, we must study historical data. Historical performance shows that Bitcoin, the leading cryptocurrency, has experienced several cycles:

- 2011: Following a rapid increase to $31, the price plummeted to $2.

- 2013: A surge to $266 ended in a fall to around $50 within weeks.

- 2017: The hype pushed Bitcoin prices to nearly $20,000, only to crash to $3,200 by the end of 2018.

These historical examples illustrate the recurring cycles, reinforcing the importance of predicting when the next cycle may occur. By analyzing data and trends, investors can prepare themselves for potential entry points.

2025: What’s Next for Crypto Market Cycles?

Looking ahead, many analysts predict that 2025 will be a pivotal year for the crypto market, with an estimated growth rate of 25% in new users emerging from the Southeast Asian market, particularly Vietnam. In fact, Vietnam saw a surge in cryptocurrency adoption, evidenced by a 300% increase in users from 2021 to 2025.

This wave of adoption may very well influence the upcoming market cycle. Investors should keep an eye on emerging cryptocurrencies and technologies within this region that might shape future trends. For example:

- Promising Altcoins: The most promising altcoins of 2025 may include those built on superior blockchain technologies that offer security and usability.

- Blockchain Adoption: Key sectors in Vietnam, such as finance and logistics, are increasingly exploring blockchain applications, fostering a tech-savvy user base.

How to Prepare for Future Market Cycles

Preparation is key when dealing with market cycles. Here are a few strategies to consider:

- Diversification: Spread your investments across various cryptocurrencies instead of concentrating in a single asset.

- Stay Informed: Regularly review market news and trends to anticipate potential shifts in sentiment.

- Risk Management: Set clear entry and exit points based on your analysis of the cycles.

Tools like Ledger Nano X can help secure assets against hacks, especially important in an unpredictable market.

Conclusion: Navigating the Future of Crypto Market Cycles

The world of cryptocurrency is rife with opportunity and danger. Understanding crypto market cycles is essential for mitigating risks and seizing opportunities as they arise. As we’ve discussed, key factors include market psychology, historical data, and emerging user growth in places like Vietnam. By employing sound strategies and remaining vigilant, you can position yourself for success in future cycles.

For more insights into the crypto world and investment strategies, explore more about magacatcoin.